As you are all certainly aware, last week the legislature passed and the governor subsequently signed HF 68. For reference, this is the voucher bill that will commit more than $900 million in the first four years of operation before becoming a standing appropriation in excess of $340 million every year thereafter. My opposition to this type of legislation is well documented over the years, most recently here. Included in the legislation were a few few nuggets for public schools, such as flexible use for some categorical funds. Many of those who support the bill tout it as allowing more flexibility for districts to free up large sums of money to put into teacher salaries. None of this is false, but is a bit misleading and out of context.

For starters, much of this flexibility had previously existed due to action by the legislature several years ago. What was added in this new bill was flexibility for both the TAG (Talented and Gifted) and TLC (Teacher Leadership and Compensation) funds. Now, when the original flexibility legislation was being debated several years ago, I had explicitly advocated for flexibility in the TAG fund because our allocation has continued to increase year over year. At that time, I was told it was a nonstarter. A redline that would never be crossed. Based on that set of facts, this year I began a deep dive of TAG and am now fully engaged in an overhaul of the program. When commissioning this project, the fact pattern was simple: it was desirable to both strengthen and improve on these services, particularly at the secondary level; and we carried a pretty large reserve fund balance that was restricted. This new legislation changes the fact pattern insofar as the reserve fund balance will now be a thing of the past. If we so desired, those monies could simply be re-appropriated to teacher salaries. In my discussion with the school board, they asked a very simple question: Would our students be well served by strengthening the TAG program? Yes. Based on that, we will proceed uninterrupted with this work.

As mentioned briefly in the preceding paragraph, the other restricted fund that school districts have been the given flexibility to re-appropriate is the TLC fund. In Hudson, we do not carry a reserve fund balance in this category. Truth be told, we have a very robust and enviable teacher leadership program. One might remember that I was around when the TLC debate was raging in the legislature back in 2010. With a start up cost of $150 million there were a lot of reservations from legislators at the time regarding the cost of the program. So much so that the 2011 legislative session ended without agreement, and a resulting 0% in SSA for the first time in Iowa history. It is peculiar that [now] we are willing to jettison the crowning achievement of a prior administration from the same party in exchange for this voucher program. In Hudson, it would make very little sense to mothball our teacher leadership program in service of freeing up funding. I would argue many of the reasons we have been so successful in moving the needle on student achievement is precisely because of this work. Yet there must be no mistake: this policy decision will cause an erosion of teacher leadership programs around the state.

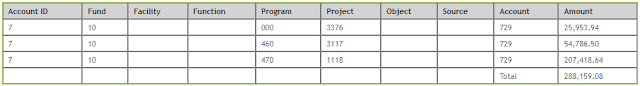

Ok, let's get down to brass tacks! What is the number for Hudson? The number that has been floating around Facebook is somewhere around $233,000. The number is pretty accurate, but the categories are not.

If that were indeed the case, in my view it would run counter to our philosophical approach of developing and managing the school budget. My practice of setting the budget is based on what many would consider 'fiscally conservative practice'. Underestimate revenue and overestimate expenditures. And never, EVER pay for ongoing expenses with one-time money. So, if we were to do what the legislature suggests and use this money to pay for salary increases, great. Let's say I'm able to give everyone an extra $2,000 in raises, exhausting that reserve fund balance. That money is now gone. What happens next year when that reserve fund balance isn't there? That $2,000 raise is no longer sustainable.

No comments:

Post a Comment