The one cent sales tax for school infrastructure has been around since the late 1990s, and was implemented to help schools address serious deficiencies in buildings. Prior to this sales tax, the primary option available to schools for infrastructure and building was a general obligation bond issue. A general obligation bond issue is a question for voters and passage requires what is known as a super majority (60%) to pass. In many cases a bond issue vote results in an increase to property taxes, so passing bond issues is no easy task. The one cent sales tax permits school districts to issue revenue bonds against future sales tax collections to address school infrastructure. At it's inception, it was a county-by county referendum that required only a simply majority of voters (50+1). School districts then had to take the extra step of passing what is known as a Revenue Purpose Statement (RPS). Our most recent RPS was passed with 96% voter approval in September of 2011. You can check out our Revenue Purpose statement right here. The point of the RPS is to outline for constituents exactly how the revenue will be invested.

Because it was a county by county issue an unseen inequity arose. Counties with large population centers likely have more (and larger) retail establishments, thus generating more in sales tax revenue for the citizens and school districts located in that particular county. Naturally, school districts in these counties were the beneficiaries of greater bonding capacity. The legislature addressed this inequity in both 2003 and in 2008. In 2003, a mechanism was designed to even out the revenue between counties, and in 2008 it was changed from a countywide sales tax to a statewide sales tax. This was met with resistance because it was believed that once it became a statewide sales tax, the legislature might at some point re-purpose this revenue away from school district infrastructure, which is contrary to the original question asked of the voters.

This is where we find ourselves today. In 2010, Iowans voted to amend article VII of the state constitution to establish a natural resources trust fund. This fund is designed in part to improve water quality in our state. However, the fund currently doesn't have any money in it. While the amendment stated that 3/8 of one cent be allocated to the fund, it only becomes effective the next time sales tax is increased. The issue became even more prevalent this past spring when the Des Moines water works filed suit in federal court, suing three northern Iowa counties for water pollution.

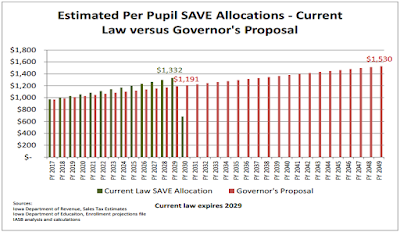

Well, there is no appetite for an increase in sales tax, so the governor has suggested diverting a portion of the revenue growth that comes from the school infrastructure sales tax to water quality programs. Currently this sales tax is scheduled to sunset in 2029, and for the last several years we have been advocating for either an extension of the sales tax or a repeal of the sunset. What the governor has proposed is extending the sales tax until 2049 (that is the good news) and capturing a portion of the revenue growth going forward (that is the bad news). Of that growth, the first $10 Million of growth would be allocated to school infrastructure, and the remaining balance of the growth would go to water quality. Additionally and unfortunately, the proposal also begins to capture this revenue immediately, which is before the original sunset expires.

As you can see from the chart, the impact of depressed revenue growth is immediate. For the current fiscal year, the per pupil allocation is around $953, which equates to approximately $621,356. If we assume a very conservative 2.83% increase in revenue, by 2029 the per pupil allocation would grow to $1,332. If enrollment remained stable, our SAVE revenue would grow to $868,484. However, under the governor's proposal, by 2029 the per pupil allocation would be $1,191. Again, assuming enrollment remains relatively stable, that would suggest the 2029 revenue stream at about $776,532. That is a difference of $91,952, but that is for that year only! This doesn't consider the compounding effect of this proposal, which tells quite a different story.

Using the same figures from above (2.83% growth and stable enrollment) from this point forward until the expiration of the sales tax, total revenue generated by SAVE will be $9,607,872. But, under the governor's plan that would be reduced by 5% or $480,393.60. That $480,393.60 would go a long way toward the renovation costs of our elementary school.

|

| Impact of Governor Branstad's SAVE Proposal (Graphic courtesy of Iowa Association of School Boards) |

Using the same figures from above (2.83% growth and stable enrollment) from this point forward until the expiration of the sales tax, total revenue generated by SAVE will be $9,607,872. But, under the governor's plan that would be reduced by 5% or $480,393.60. That $480,393.60 would go a long way toward the renovation costs of our elementary school.

A special thank you to Shawn Snyder, IASB Financial Support Director for his assistance with these calculations.

No comments:

Post a Comment